If you wish to buy a Bitcoin, for instance, then your account will grow in value as Bitcoin’s price increases. If Bitcoin price decreases, then your account loses value accordingly. Apart from a standard trade (purchase), Prime platform allows you to open a position that will increase in value as the Stocks decreases in price. This is referred to as selling or going short, as opposed to buying or going long.

Open an account to start Investing now – it’s free, simple and takes only 40 seconds

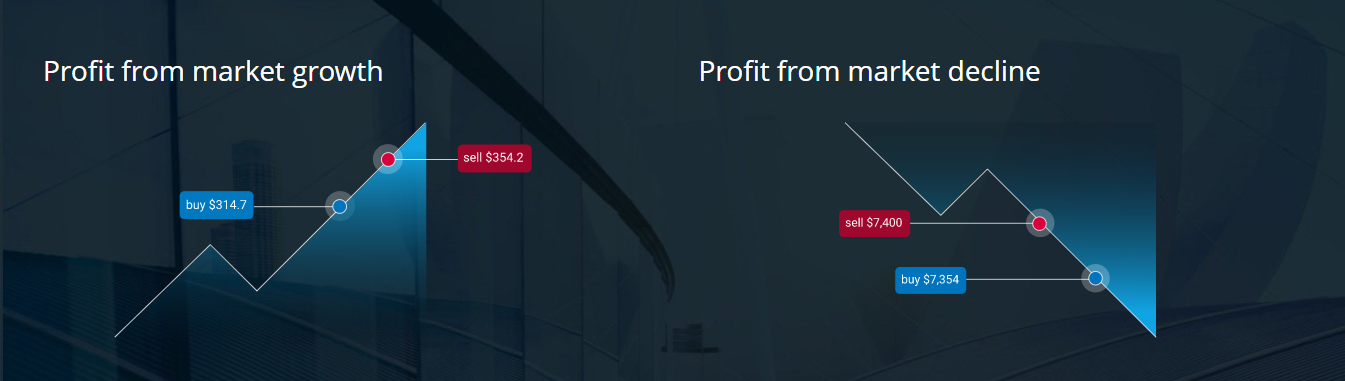

Say Ethereum market price is $314.7. You think that the Ethereum price will go up, so you buy 200 of ETH’s at $314.7. This is equal to the position value of $62,940.

Because Prime offers leveraged Investing, you don’t need to put up the full value of this trade. Instead, you only need to cover the margin, which equals to 1% of a total position size, or $629.40.

If your prediction is correct and ETH price climbs, you may decide to fix a profit. Ethereum price is $354.2 and you close your position.

To calculate your profit, you need to multiply the difference between the closing price and the opening price of your position by its size.

354.2-314.7=39.5, which you multiply by 200 and get a profit of $7,900 because you had a “long” position.

e Bitcoin is Investing around $7,400. You anticipate the upcoming negative news about Stocks market, which will negatively impact the price of BTC, so you decide to sell ten Bitcoins at $7,400 for a total short position of $74,000 in value.

Bitcoin has a margin requirement of 1% (1:100 leverage) so you need to deposit $74,000×1%=$740 as margin collateral.

The announcement is a disappointing one, and Bitcoin drops to $7,354. You’re ready to secure your profit, so you buy back 10 BTC at $7,354

Because this is a short position, you deduct the closing price ($7,354) from the opening price ($7,400) of your position to calculate profit, before multiplying by its size of 10.